aurora co sales tax rate

However the Department does not administer and collect sales taxes imposed by certain home-rule cities that instead administer their own sales taxes. Aurora NE Sales Tax Rate.

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

XYZ must pay 375 percent Aurora use tax on all cash registers including those to be shipped to stores outside of Aurora.

. The vendor did not charge XYZ Aurora sales tax. The Aurora sales tax rate is. The minimum combined 2022 sales tax rate for Aurora Colorado is.

XYZ will include this on line 10 of their Aurora Sales and Use Tax return. Aurora co sales tax rate. The Colorado Department of Revenue administers not only state sales tax but also the sales taxes imposed by a number of cities counties and special districts in Colorado.

You can find more tax rates and allowances for Aurora and Colorado in the 2022 Colorado Tax Tables. With CD 290 000 010 025 375. This is the total of state county and city sales tax rates.

The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax. The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax. Aurora CO Sales Tax Rate.

OH Sales Tax Rate. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax. The current total local sales tax rate in Aurora OH is 7000.

The December 2020 total. November 27 2012 500 pm Colorado Springs Tax Services. The current total local sales tax rate in Aurora NE is 5500.

4 rows The current total local sales tax rate in Aurora CO is 8000. The Colorado sales tax rate is currently. 5 rows The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams.

Aurora is Colorados third largest city with a diverse population of more than 381000. From agricultural outpost to military bastion Aurora established its foundation as a driving force in the west. Welcome to the official website of City of Aurora.

They will be stored in Aurora and shipped to various stores in and out of Aurora as needed. The December 2020 total local sales tax rate was also 5500. The city of Aurora imposes an 8 tax rate on all transactions of furnishing a room or rooms or other accommodations by any person or persons who for consideration use possess or have the right to use or possess any room or rooms in a hotel apartment hotel lodging house motor hotel guest house bed and breakfast residence guest ranch mobile home auto camp trailer.

The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. Colorado Springs Tax Services in Colorado - Have a State of Colorado licensed and experienced CPA help with your accounting and tax related needs. 2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY.

The County sales tax rate is. 6 rows Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec.

The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc. Aurora-RTD 290 100 010 025 375. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

Boulder CO Sales. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Aurora CO. Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51.

The December 2020 total local sales tax rate was 7250. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing.

While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora does not currently collect a local sales tax. Arvada CO Sales Tax Rate.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Aurora Property Tax 2021 Calculator Rates Wowa Ca

Sales Tax Rates Douglas County Government

How Colorado Taxes Work Auto Dealers Dealr Tax

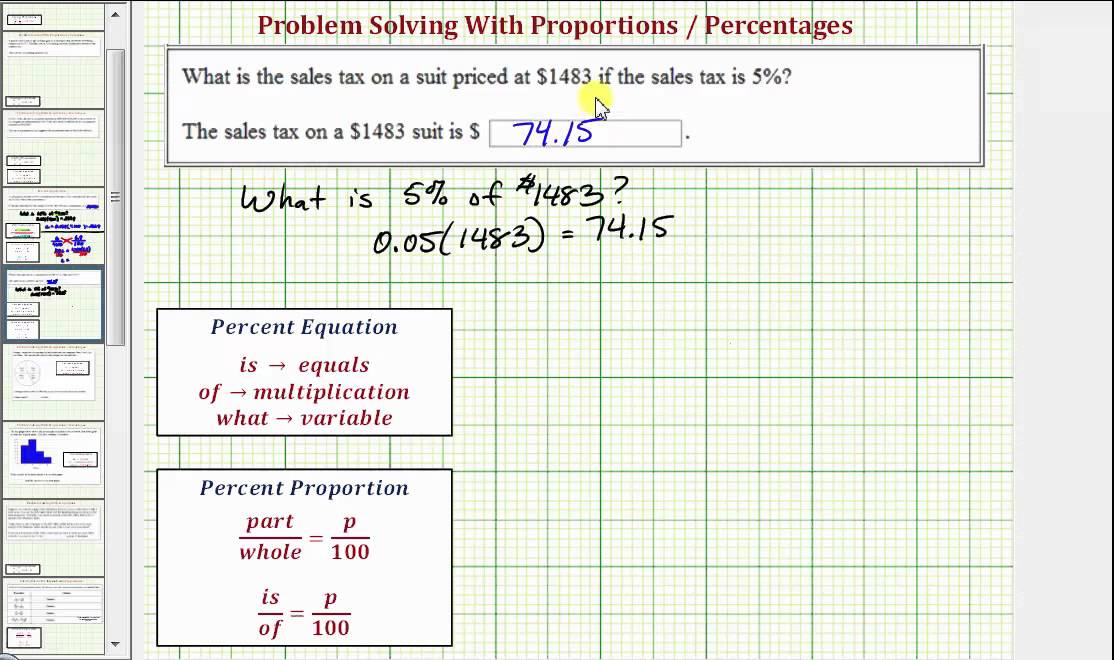

Solving Sales Tax Applications Prealgebra

Aurora Colorado Sales Tax Rate Sales Taxes By City

Aurora Kane County Illinois Sales Tax Rate

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Solving Sales Tax Applications Prealgebra

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Solving Sales Tax Applications Prealgebra

Manitoba Property Tax Rates Calculator Wowa Ca

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

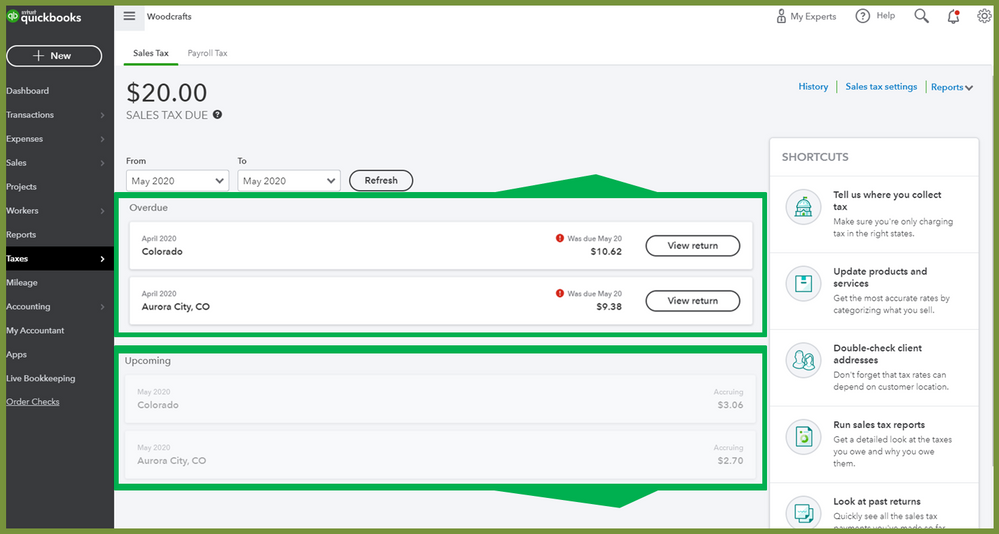

Set Up Automated Sales Tax Center

How Colorado Taxes Work Auto Dealers Dealr Tax

Property Tax Village Of Carol Stream Il